Sollio Cooperative Group’s 100th anniversary will go down in our collective memory as a time fraught with significant challenges, as reflected by our financial results for the past fiscal year.

With consolidated sales of over $8 billion, Sollio Cooperative Group recorded a loss before patronage refunds and income taxes of $18.7 million.

The previous year’s strong results generated significant returns in cash and share redemptions, in addition to putting us on the right foot to head into the new fiscal year.

That being said, 2021 brought a series of negative events with a cascade of adverse effects, disrupting our annual planning and forecasts.

We were targeted in the surge of systems hacking that is threatening every organization worldwide. Olymel and BMR Group faced logistics issues due to COVID-19, such as high container prices and supply disruptions. Volatile commodity prices significantly impacted inventory values, particularly in the grain and lumber sectors.

Olymel’s hog business clearly faced the most adverse environment. I refer to the severe labour shortages associated with the demographic mismatch in the labour market, on top of the health restrictions resulting from the COVID-19 pandemic.

The labour shortage resulted in prioritizing the pace of slaughter and producing low-margin primary cuts, at the expense of processing value-added cuts. The detrimental impact on margins was even greater for certain of our plants whose export permits to China were suspended due to geopolitical circumstances. Note that China is a unique world market for the utilization of hog by-products.

Québec's pork pricing formula puts us at a disadvantage compared with our Canadian and North American competitors. The formula’s impact was even greater in 2021, given our inability to fully process cuts and the loss of the Chinese market to move primary cuts.

The volume of hogs awaiting slaughter in Québec rose to record levels during the fiscal year, compounded by the months-long strike at the Vallée-Jonction plant. Olymel made every effort to avoid President’s message Ghislain Gervais 2021 last resort solutions such as compassionate slaughter. Slaughter volume was given priority over processing. Piglets and hogs were shipped outside Québec. All of these actions helped to reduce pressure, but they also led to additional losses of revenue.

Sollio Agriculture’s grain sector faced a difficult-to-predict reverse market. Steps were taken to correct the situation, but the financial consequences were substantial.

On the positive side, several of our operating sectors performed very well despite the difficult environment. BMR Group recorded excellent results, benefiting from the impact of the pandemic and the rage for renovation, among other things. I would like to also highlight Olymel’s poultry operations, Sollio Agriculture’s animal and crop production, and the energy sector. All of these sectors generated gains in line with or well above expectations.

Our network of cooperatives is the picture of health. The financial strength of our agricultural cooperatives grows deeper year by year. Our far-reaching network reorganization plan, Vision Plus, has certainly played a part in this.

These outcomes illustrate the importance of diversifying our operations. Some of our sectors deliver stable results year after year, which helps to maintain Sollio Cooperative Group’s resilience.

And once again during the year, our financial partners showed their continued confidence in us by making equity investments and renewing our credit facility. We would like to thank them warmly for their support for our organization and cooperative business model.

We achieved another important milestone during the year by completing a generational leadership transition at Sollio Cooperative Group and across all divisions. The implementation of our succession plan involved a rigorous and orderly process rolled out over many months.

In that regard, I want to reflect on the departure in the past year of two of our organization’s stalwart champions, Mr. Gaétan Desroches and Mr. Réjean Nadeau.

Gaétan Desroches, CEO of Sollio Cooperative Group, retired last September after a career of 40 years within our network. Under his leadership, Sollio Cooperative Group consistently grew and consolidated its position as a frontrunner in Canada’s agri-food chain and retail industry.

And we were deeply saddened by the sudden death of Réjean Nadeau, President and CEO of Olymel, on October 14, 2021. During the 25 years of his stewardship, Olymel, which now numbers over 14,000 employees, grew from sales of some hundreds of millions of dollars to $4.2 billion.

On behalf of the members of our Board of Directors, our employees and our members, I want to thank them wholeheartedly for their remarkable work, their tireless dedication and their high esteem for agricultural producers.

I would also like to take this opportunity to congratulate their successors, both from within our organization. Mr. Pascal Houle, as CEO of Sollio Cooperative Group and Mr. Yanick Gervais, as President and CEO of Olymel. And I want to congratulate Mr. Casper Kaastra, the new CEO of Sollio Agriculture, and Mr. Alexandre Lefebvre, the new CEO of BMR Group, who joined us during the year.

The members of the Board of Directors of Sollio Cooperative Group and Olymel are confident that they will successfully carry on their predecessors’ work and leverage their skills to continue building our organizations.

And I want to extend my thanks to their respective teams and to our more than 16,000 employees, who have shown such commitment to our organization as we continued to adapt to the many demands made by COVID-19.

A thriving network

Our network of cooperatives is the picture of health. The financial strength of our agricultural cooperatives grows deeper year by year. Our far-reaching network reorganization plan, Vision Plus, has certainly played a part in this.

You’ll recall that Vision Plus supports the consolidation of our agricultural cooperatives and business partnerships with our Sollio Agriculture division. Launched in 2016, the initiative was in response to a desire by our elected officials to modernize our business model to better meet producers’ needs and ensure network sustainability in a highly consolidated market environment.

Today, it is clear that the consolidation of the agricultural cooperatives, which is already well underway, has generated significant leverage in securing their sustainability. It is also clear that our consolidated businesses are in a much stronger position to face the major challenges of today and tomorrow.

Further of note, Agiska Coopérative launched formally on November 1, 2021 consolidating cooperatives in the Montérégie region under a robust new regional umbrella. Avantis Coopérative has gained new strength through the inclusion of La Coop Alliance in its fold.

The business partnerships that we have formed with our consolidated cooperatives are also giant steps towards a stronger network. These combinations make us even more competitive and enhance the common bond that defines us.

Today, it is clear that the consolidation of the agricultural cooperatives, which is already well underway, has generated significant leverage in securing their sustainability.

The development of regional partnerships continued to gain momentum this year, with the official launches of Sollio & Agiska Agriculture Coopérative and Sollio & Uniag Agriculture Coopérative. Note also that Agriscar Coopérative and Novago Coopérative recently united within Sollio & Grains Québec Agriculture Coopérative.

Other consolidation projects are underway and will take shape over the coming years. Vision Plus is a dynamic, scalable project, and that is what will ensure its long-term success. Our network’s landscape has evolved significantly over the past few years and demonstrates the soundness of our vision and ambition. Together, we will go farther.

Sollio for tomorrow

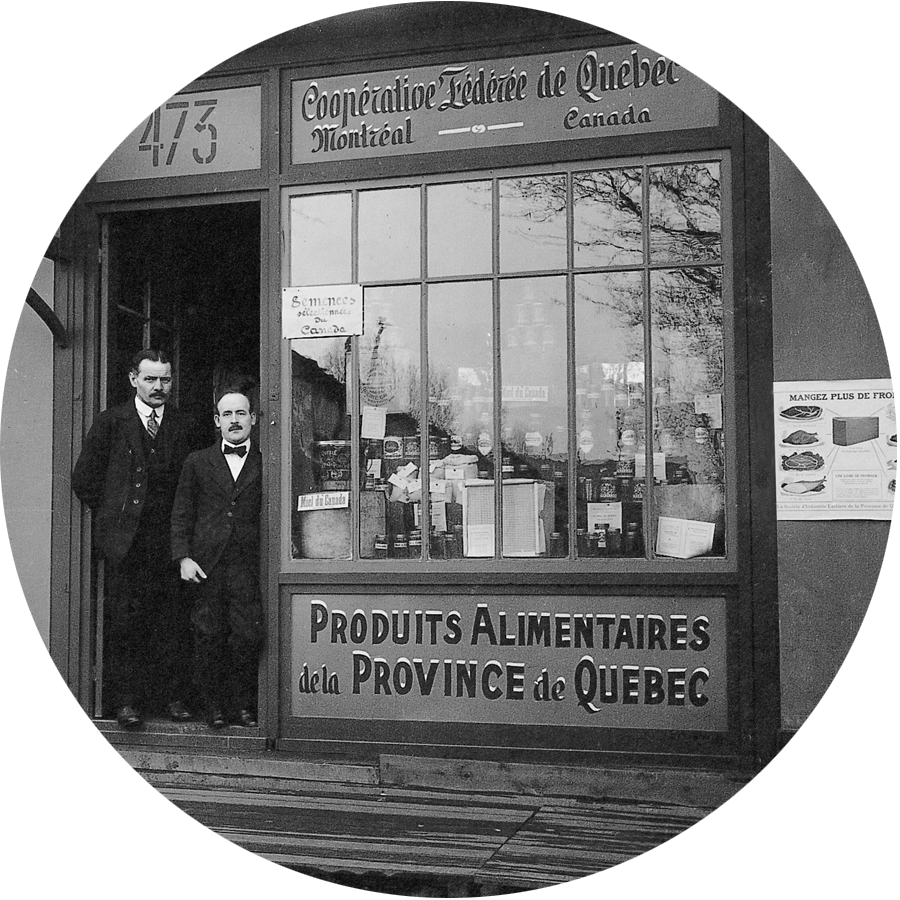

Over its 100-year history, Sollio Cooperative Group has reaped abundant success and faced down many crises.

After many years of growth and given the financial results of the past fiscal year, an asset optimization project is currently underway. This is essential to putting Sollio Cooperative Group and Olymel back on stable footing. Furthermore, Olymel initiated a plan to improve hog operations, which will be fully implemented in the coming months.

Beyond economic considerations, we continued our work on the cornerstones of our cooperative model. Among other things, the Board of Directors approved the recommendations of the ad hoc Governance Committee, which addressed Board of Directors succession strategy, Board representation and composition, and the integration of women into our decision-making bodies.

In that regard, we continued to deploy the Action Plan for the Equitable Representation of Women in Network Governance. Among other things, in 2021 we reached our target of three women on the Board of Directors. However, work remains to be done to reach our target of 30% by 2025.

We also maintained our structured approach to corporate responsibility. Together, we must continue to seek solutions to the different environmental and social challenges. The builders of yesteryear left us a unique heritage. Those who came before us were farsighted in creating a broad-based cooperative network to provide mutual services, support and sharing. They could never have imagined the scale their cooperative would achieve 100 years down the road.

According to the World Cooperative Monitor, Sollio Cooperative Group ranks 104th among the world’s 300 largest cooperatives. Its contribution to driving the Canadian and regional economies has been significant from its very beginnings in 1922.

Sollio Cooperative Group’s direct and induced benefits contribute over $4 billion to Canada’s GDP and generate nearly 40,000 full-time jobs. Its operations generate annual tax revenues of about $1 billion per year for federal and provincial governments. Those are numbers that would make our forerunners proud.

But the heritage those builders left to us carries its own weight of responsibilities. It’s our turn to nurture it. It’s our turn to make it sustainable. It’s our turn to leave an enduring heritage for future generations of farm cooperators. And you can be sure that those responsibilities and our values guide our actions and decisions day after day.

In its 100 years of growing, this is not the first time our cooperative has faced down major challenges. And it’s pretty much a sure thing that it won’t be the last.

But as in the past, when times get tough, we do what we need to do to get ourselves into a better position for the future. Our history has shown us time and time again that our cooperative model is durable and resilient, just like our farming members.

To conclude, I would like to extend my thanks to my colleagues on the Board of Directors for their solidarity, their professionalism, and their trust in me. And I applaud all of the directors across the network. It is your commitment and determination that give real meaning to our collective action!